Month: March 2025

When we last looked in on the ongoing saga of the Corporate Transparency Act (CTA) and its Beneficial Ownership Information (BOI) reporting requirement enforced by the Financial Crimes Enforcement Network (FinCEN), the Treasury Department had issued a press release which appeared to do away with the BOI reporting requirement, except for foreign reporting companies. In…

Read MoreAnyone doing a like-kind exchange under IRC Section 1031, or anyone familiar with the 1031 exchange cottage industry, might also be aware of the sub-cottage industry of providing replacement property alternatives to taxpayers doing exchanges. One of the most popular products offered by these helpful providers is an interest in a Delaware Statutory Trust (DST). …

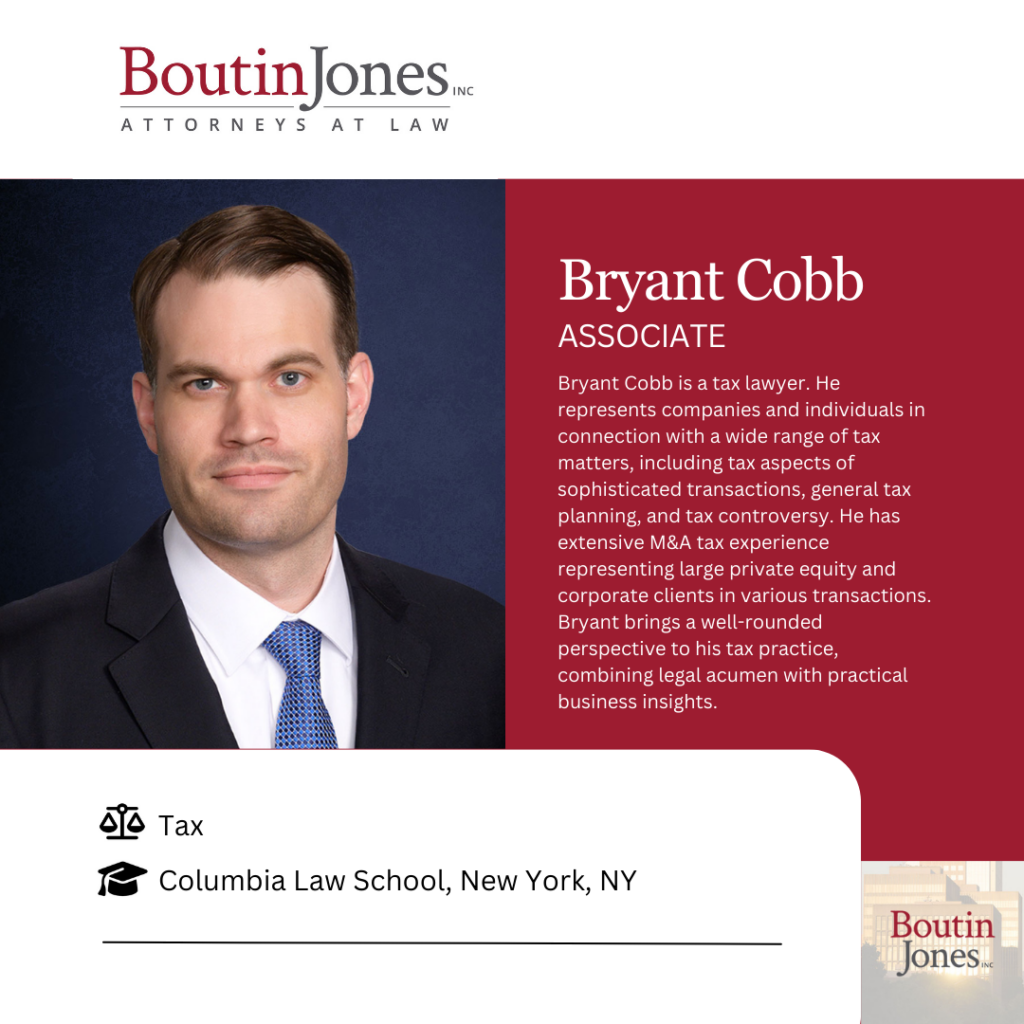

Read MoreWe are thrilled to introduce Bryant Cobb, our newest tax associate. Bryant represents companies and individuals in connection with a wide range of tax matters, including tax aspects of sophisticated transactions, general tax planning, and tax controversy. Please join us in welcoming Bryant to the firm.

Read MoreIn our last installment regarding the wild ride of the Corporate Transparency Act (CTA) and its Beneficial Ownership Information (BOI) reporting requirement enforced by the Financial Crimes Enforcement Network (FinCEN), we reported that the BOI reporting requirement was back in force. The court in Smith v. U.S. Department of the Treasury had stayed its injunction,…

Read More